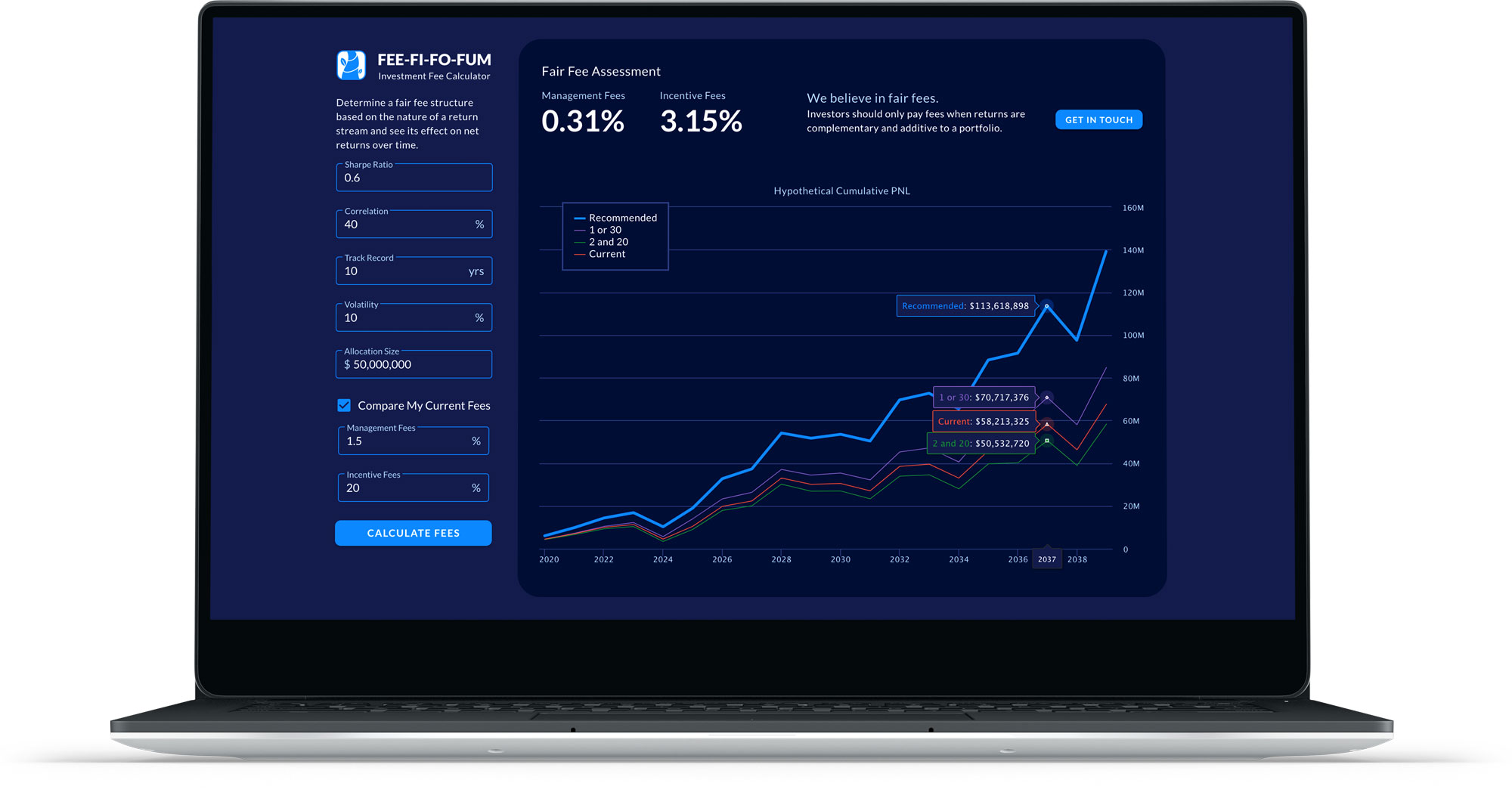

LOUISVILLE, Ky. - Ramsey Quantitative Systems, Inc. (RQSI) has launched Fee-Fi-Fo-Fum, an investment fee tool that generates a fair fee structure based on the core nature of a return stream. In addition to calculating a recommended fee model, the tool enables users to input their current managers’ fees to see how they compare against RQSI’s recommended model, the standard 2-and-20 structure, and the more recently adopted 1-or-30 structure.

“We believe that fees should hinge upon the impact of the fund in the context of the entire portfolio,” said Neil Ramsey, CEO of RQSI. “Our goal is not to challenge our competitors’ fee structures, but to educate investors on how to assess management and incentive fees when making important investment decisions.”

RQSI’s investment fee calculator presents a logical framework that estimates the fees a return stream deserves based on a few simple criteria: Sharpe ratio, correlation to benchmark, annualized volatility, track record length, and allocation size. This standardized framework allows users to evaluate liquid alternative managers, passive traditional managers, and everything in between. Fee-Fi-Fo-Fum gives hypotheses to interesting questions like:

- What kind of performance would a manager need to produce to earn the standard 2-and-20?

- How much is an equity long-short manager that's 40% correlated to the S&P500 with 10% annualized volatility and 1.0 Sharpe ratio worth?

- What justifies a larger expense ratio for a large cap equity ETF than a bond ETF?

With hedge fund returns lagging behind benchmarks year after year since 2008’s financial crisis, managers have responded by lowering or waiving hedge fund fees outright to entice investors back into the fold, indicating a shift toward more investor-friendly fee agreements. RQSI approaches fees in a more nuanced way by adjusting rates based on whether the chosen product is complementary and additive to an investor’s core portfolio. The firm’s recent pivot to customizable alternatives supports the focus on portfolio fit by charging fees only for value-added performance.

To get started, check out Fee-Fi-Fo-Fum on RQSI.com.

About RQSI

Ramsey Quantitative Systems, Inc. (RQSI) is a quantitative investment management firm headquartered in Louisville, Kentucky. Founded in 1986 by Neil Ramsey, RQSI has been a pioneer in systematic trading for over 34 years. RQSI’s quantitative funds have earned numerous accolades including a recent 2019 win for Best Systematic Macro Fund at the HFM Global CTA Intelligence Awards.