“Inflation is always and everywhere a monetary phenomenon.”

- Milton Friedman

Large-cap global equities are universally loved. All economic forecasts have the same conclusion: 2021 will be positive for global stocks due to no/low inflation, little risk of higher interest rates, accommodative central banks, strong earnings potential, stable growth, herd immunity, etc. The list goes on.

How does one then make the case for a cautious outlook for stocks?

When any thesis is reliant on one primary variable, its conclusion becomes circular and definitive; all scenarios lead to the same outcome. Interest rates are the variable, though immovable because of no inflation and central bank resolve. This is the right conclusion until it’s not – and we are too close to the “it’s not” to maintain high levels of equity exposure.

Deutsche Bank strategist Jim Reid wrote in a note to clients on Monday, December 14, 2020 that a key takeaway for the market in 2021 is that a risk-friendly, U.S. equities-heavy approach is “extremely consensus for the next 12 months.”

The consensus felt so extreme that Reid wondered if this bullish case for 2021 S&P forecasts was the “biggest consensus in history.”

“It’s fair to say that in the 25 years I’ve been doing this I can’t remember a time when so few (if any) disputed the central narrative,” Reid wrote. “Is this a warning sign or a reflection that the vaccine news has been uniformly positive and game-changing over the last 5 weeks?”

“Inflation consists of subsidizing expenditures that give no returns with money that does not exist.”

- Jacques Rueff

Real yields are very low and will likely climb higher, at least to match inflation expectations. And, while inflation has stayed at bay since 2009 despite round after round of money creation, why would it rise now? When you’ve finally filled the hole known as global excess capacity, the phase shift is fast and nonlinear. We are closer to that vacuum of excess liquidity being filled than consensus suggests.

I’ve heard it said that “it either is or it’s not,” but the concept of inflation defies this phrase. I’ve read many pieces that say we will be talking about inflation in the second half of 2021, but that makes no sense. The forces for an inflationary spike either exist or they don’t. If they exist, the time is on us. If they don’t, inflation is unlikely in the second half of 2021.

Anyone trying to buy a $400,000 to $900,000 house in markets like Nashville can tell you why inflation is already here, as can anyone in construction trying to bid for jobs or pin down subcontractors. Real price pressures are already here and to a large extent, are driven by low real interest rates. We have worked from the basis of excess supply since 2009 and are starting to see supply issues in some assets, services and commodities.

Even our traditional 12 days of Christmas is showing inflation:

- Two turtle doves — Cost: $450. The costs of these love birds increased more than any other item on the list, up 50% from 2019.

- Three French hens — Cost: $210. Up 15% from last year."

Source: PNC

We have been trained to not believe our economics 101 teaching – that excess money supply and low interest rates lead to inflation. Manufacturing supply and distribution channels were massively underutilized between 2008-2010, creating a deep hole and it has taken us 10 years to catch up.

Inflation is not a linear function. To understand how inflation works, do a quick study on March 2020 toilet paper purchasing – a whiff of short supply sent pricing and demand into a frenzy.

Blindness to impending inflation risk is resulting in exorbitantly over-optimistic valuations and earnings estimates in the stock market. Here are a few facts to consider when asking if stock sentiment is too positive:

- The put-to-call ratio for U.S. stocks just hit its lowest level since 2000.

- Options volume has surged to its highest on record.

- 21.6% of all call options were bought by small traders, the largest level since the tech bubble.

- Median short interest for the S&P 500 has plunged to 17-year lows.

- We now have the largest percent of S&P 500 members above their 200-day moving average in 7 years.

- Market sentiment is at its highest level since just prior to the Volmageddon shock in 2018. (Investors Intelligence)

- For the first time in 15 years, 60% of SentimenTrader’s indicators are showing an excessive amount of optimism – the highest reading yet.

- Short Interest in U.S. equities is as low as it’s ever been since the full acceptance of long / short and market-neutral equity investing.

The bullish frenzy has been driven by all-time low interest rates and narrow credit spreads. These two factors coincidentally received the highest weight in the Goldman Sachs Financial Conditions Index, which recently made a new low-water mark, signifying the extreme in the enabling mechanism for today’s speculative imbalances. The four prior cyclical lows in this index precipitated the tech bust in the early 2000s, the global financial crisis in 2008, the emerging market meltdown of 2015, and Volmageddon in 2018.

Consider the following summary of how analysts are viewing current and future earnings for the SP500:

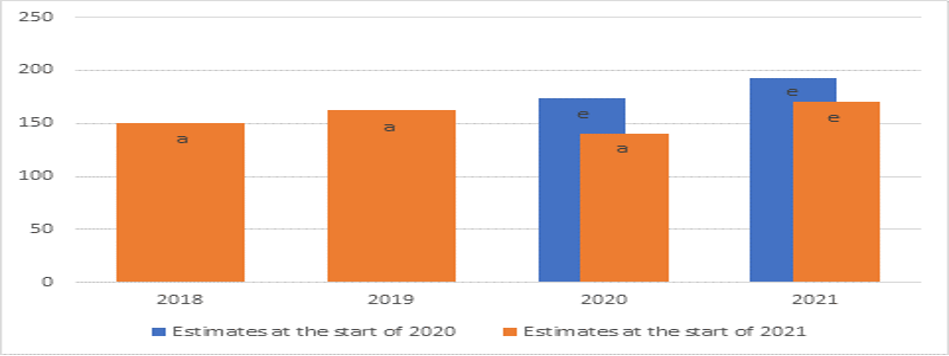

This year started with estimated earnings for the S&P500 of 174 for 2020 and 193 for 2021. This was a 7.4% increase from 2019 earnings of 162, which was 8% higher than 2018. The 2021 expectation at the start of 2020 was an extremely optimistic 10.9% increase over the 2020 expectation. We began 2020 with a very optimistic bullish tone, which stocks reflected with a very strong start in January 2020.

We are finishing 2020 with estimated earnings of 140 for the S&P 500 for 2020 and 170 for 2021. Do the math: Earnings are almost 18% below expectations for the year and the market is up close to 20%. That means we shrunk earnings from 2019 by 13.5% and the market rallied 20%. Why? Because the new 2021 estimated earnings are 4.9% above the 2019 earnings? No, because interest rates are expected to remain low for the foreseeable future.

How can the market simply ignore...

- the likely overexuberant earnings expectations? (Which are well below estimates one year ago)

- the potential for higher taxes?

- the risk that China, Russia, and/or North Korea will challenge a new U.S. president who has shown to be soft on tough issues?

- high valuations by all traditional standards?

Inflation expectations are at the core of faulty market theses and the market is underestimating the risk of inflation.

“I continue to believe that the American people have a love-hate relationship with inflation. They hate inflation but love everything that causes it.”

- William E. Simon

Even without inflation becoming the catalyst for higher interest rates and cascading risk across the system, it doesn’t take a lot of creativity to imagine many other scenarios that burst the euphoria of this equity rally. Let’s imagine a few:

- Russia, China, or North Korea (or all three) do something to provoke the new administration.

- Emerging market debt defaults crush these economies.

- Oil rallies to $80, or worse yet, craters to $20 as OPEC folds.

- President Biden has to step down and Kamala Harris becomes president.

- The new U.S. Treasury Secretary embarks on an aggressive dollar-devaluation program.

- The U.S. Treasury struggles to refinance the $5.1 trillion debt maturing in 2021.

- The excess valuations bring new short-sellers into the market, as there are too many Tesla/Airbnb/Doordash-esque opportunities to ignore.

- The vaccine doesn’t work as well as expected and doesn’t last as long as needed.

- A chaotic non-predictable reaction to the latest round of censorship by digital media monopolies.

- The economy expands rapidly and we have massive labor shortages. (...wait, that’s inflationary as well).

The market is at a very high-risk level to be fully invested today for a few simple reasons: Rates are likely to rise, valuations and expectations are unsustainably high, and the natural balance of respect for risk is off-kilter. For large pensions and endowments, equity allocations should be at the lower end of your IPS; do not move money to fixed income. For individuals and 401k plans, do not hold over 50% equities. For traders, seek opportunities to aggressively short the market.

We return to the single, circular variable: interest rates. Stocks are more attractive because rates are lower. Since rates are lower, investors should allocate to equities instead of fixed income. The crux of the issue: earnings are artificially buoyed higher by lower interest rates and Fed-supplied liquidity. This should explain succinctly why investors need to be more cautious.

I fully understand the unbearable nature of watching the market rally another 20% and not being fully invested. But the good news is you won’t get it thrown in your face at cocktail parties with COVID-19 keeping everyone apart.