When I started in systematic trading, the Berlin Wall was still up. Suffice it to say, I’m comfortable with the concept, but I can understand people who aren’t. Especially with the Big Tech backdrop of today, trust in algorithms as a whole is low. Nonetheless, I am always entertained by someone criticizing Systematic Trading as a “black box” in contrast to the human mind feeding discretionary trading approaches.

Systematic Trading Defined

An investing approach that utilizes rule-based trading algorithms. There is no human intervention, therefore it is insulated from emotional decisions in stress periods.

Discretionary Trading Defined

An investing approach that relies on human decision. Managers may use tools and technologies to aid in analysis, but at the end of the day it’s a human pulling the trigger.

There is nothing more convoluted and perplexing than the autonomous human mind. The concern that systematic trading is a “black box” – implying that its rules and logic are hidden from the investor – pales in comparison to the impossibility of fully understanding what drives a discretionary trader’s decisions. Is it really easier to understand what comes out of a discretionary trader’s head and translates into a trading program? Can you identify the exact anomaly he is exploiting and guarantee he will stay rational and consistent regardless of what’s going on in his life and what new market condition exists?

I would always argue that the human brain’s ability to assess new information is better than any systematic strategy’s ability to do so. I would also argue that it’s unlikely a human can stay focused and consistent across a wide range of markets and conditions as a systematic strategy does. Systematic investing strategies have the benefit of producing historical expectations that can be compared to real experience and the further advantage of having rules that can be understood and replicated.

What makes a good systematic trading model?

A systematic trading model is a fully defined rule-based trading algorithm that utilizes clear data definition, data collection and data manipulation approaches for the data input; applies rules for entry and exit signals; and in turn determines the execution assumptions. If any part of this process is subject to human intervention, it is not a systematic trading model; it’s a cheat sheet. It may be repeatable and based on sound logic, but it is still not systematic trading. If we are indeed looking at a systematic trading model, the following evaluation criteria are what we feel differentiates a solid model from a lackluster one:

A.The model is guided by an overarching market philosophy and an understood market anomaly that can be explained. Before the model is built, its trading rules should be hypothesis-based and capture the essence of the trading strategy. Before defining any parameters, the price or behavior anomaly being exploited can be described in simple terms. The hypothesis was conceived with an understanding of how markets work. A really smart guy with little market experience and access to data is akin to a chimp with a machine gun.

B.The model follows Occam's razor: the simplest explanation is usually the right one. It should have low complexity, simple rules, few parameters and easily implementable entry/exit logic. Inputs and parameters are linear and not curve-fit to the historical data used to test the hypothesis.

C.Most importantly, the model must perform as you would expect in future environments. No trading model functions in a vacuum; a good model has a specialized niche and is built to produce results in the context of an existing portfolio. This means that the return characteristics, risk contribution and correlation to other components all must be consistent over time. There is no minimum threshold for return expectation. You could build a good systematic trading model that has negative cumulative expected returns but provides protection during a portfolio disaster. As long as return, risk and correlation all behave as expected, the trading model can still add value if applied consistently within a portfolio.

D.The model is transferrable and robust across assets and market conditions. Like scientific theory, the best trading models are characterized by the number of domains where they have explanatory power. Furthermore, when a model is applied to several different instruments and assets, it needs to identify ways in which the instruments and assets are unique so that the analysis is of the correct core components the strategy is exploiting. For example, with simple trend-following models, price appreciation can be in the form of Cash prices rising or derivative instruments having positive Carry. It’s important to understand market differences when applying model logic.

E.The model is supported by a reliable and consistent data infrastructure for both its testing and its live trading. The evidence gathered to evaluate the trading model before implementation must present itself in the same way that the data will be process when the model is traded. In other words, if the data you test with is not the data you trade with, it’s not a good model. This is particularly problematic with economic release data that can have variable measurement times and time-of-release lags.

F.The model is adaptive to changes in market conditions and designed to handle markets that change character over time. Market participants and volatility structures can change, which has an impact on the efficacy of your model. The model must be followed under all circumstances unless there are predefined circumstances that would render its signals random. This is why it is critical the model be designed across cycles to avoid trying to be overly optimized to catch the last rally or sell-off. If it doesn’t work over time or it can create unexpected trades at the wrong time, it’s not a good model.

G.The author of the model designs a re-evaluation framework to determine that the model is robust over time. A cynic might say, “If it’s a good trading model, you shouldn’t need this.” But the Batmobile has a self-destruct button for a reason, and the fact that it does is no indication that it’s a bad vehicle.

H.An experienced team that can adapt and re-evaluate the model and its ongoing applicability and improvement. This item may be listed last with few words, but it is the single most important element. Having the right people in place is essential to building a successful systematic business.

If you can build a systematic trading model that satisfies all of these criteria, and it is useful in the context of a broader portfolio or strategy, you likely have a good model. Next, we will consider how a model fits into a portfolio.

What makes a good systematic trading program?

A trading program is merely a collection of trading models. A good trading program is a thoughtful collection of trading models that incorporate multiple levels of diversification. Diversifying with assets, frequency signals, and approaches is key to building a solid systematic trading program.

How you combine things makes a difference. This can be as simple as the offering from a single manager or an entire institutional portfolio meant to function like a symphony of parts. There are some single trading models that are trading programs, but most systematic asset management firms have multiple models meant to capture different timeframes and anomalies in a single portfolio.

While a good trading program satisfies all the criteria above, we need to consider the importance of specific return requirements when constructing a trading program. A good trading program must:

A. Do something you already do, only better. True Alpha

We think of Long / Short Equity managers as an alternative source of Beta to an existing Equity allocation, but returns must be better than risk-adjusted returns from index buy- and-hold, net of fees.

OR

B. Stand alone as a diversifying return in your portfolio. Orthogonal Return

Liquid Alternative investments are not supposed to amplify what you already have in your portfolio, but tend to have positive Beta during drawdowns, thus negating the value. More of a bad thing is not a good thing.

OR

C. Provide Return and true negative Beta in your portfolio. Nirvana

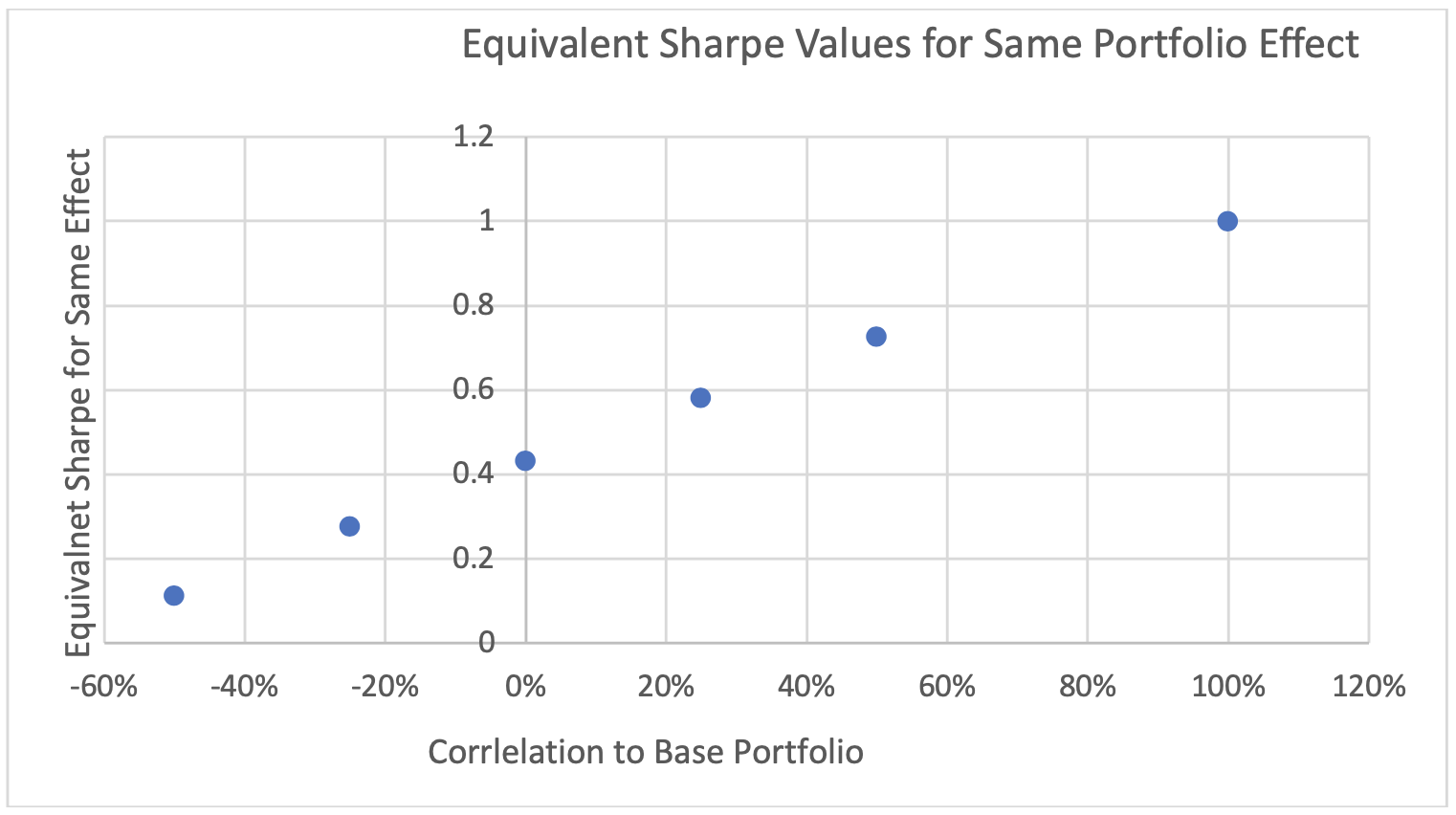

This is what Liquid Alternative investments need to become to make a difference in their client portfolios. The chart on the following page shows the impact of adding a strategy to an existing portfolio. We all want to add high Sharpe ratio strategies to our portfolio, but the reality is that adding lower correlation strategies is more likely to add value in the long run. The chart demonstrates that if your portfolio has a 1.0 Sharpe, a strategy that is 100% correlated to your existing portfolio must have in excess of a 1.0 Sharpe to add value to your portfolio. Similarly, adding a zero-correlated strategy requires a minimum of a .45 Sharpe.

As the graph demonstrates, as the correlation of a strategy gets lower to your portfolio, the required Sharpe to add value decreases. We would argue that it is easier to build models with predictable correlation structure than predictable return outcomes. The key to adding value to an Investor’s portfolio as an outside manager as described above is giving them either better returns or more diversification. If you can do both, this clearly adds real value to their trading. In fact, while it may not be obvious that a program with a low Sharpe can be additive, if it’s not correlated to the portfolio it can add huge value.

When evaluating a prospective manager, you must be confident that all the criteria of a good trading model are accounted for. But more importantly, the manager must clearly identify what value it is designed to provide and demonstrate clear evidence of its ability to do so.

If you allocate to a systematic trading program that ends up losing money, when should you stick with it?

We have all experienced a drawdown or a mark-to-market loss in an investment. Those who allocate to outside managers or build trading models have at some point all been disappointed by the results they see. When a sustained loss occurs, all decisions should be made by assessing the forward-looking expectation of return, which of course is highly dependent on assessing the loss relative to past market conditions and the expected return profile of the strategy.

If a manager or model you allocated to is in a drawdown more severe than you expected, consider what the loss says about the strategy you chose. Is it...

A. Dumb.

This could be fraud, misrepresented performance, incompetence or simply a bad hypothesis. You made a decision with bad information and should exit immediately because you simply misunderstood the risk.

B. Broken.

This requires a much more complex nuanced decision and thought process.

This could be a strategy that is no longer relevant. It could be a fund where key people depart. It could be a trading idea that doesn’t apply to a new market condition. It could be a product that is no longer valuable to a customer base. You need to exit because you don’t have a positive expected return. A model that is dependent on increased Equity and Bond gains from an endless stream of FED QE could be an example.

b. Not hopeless.

But not as good as envisioned. This is similar, but you still have a positive expected return. The question is whether or not the expected return still compensates you adequately for the risk you have. Don’t be in a hurry to exit, but dig in and work harder to assess your forward risk/reward. Also, here is where you really need to understand the diversification aspect of the model. If the loss is because it was designed to hedge equity market risk in a seemingly non-stop upward rally in stocks, it would be surprising if the model didn’t lose money during this time. If you invested for the insurance aspect of a strategy and have been disappointed by the losses, you got what was expected but not what you had hoped.

C. Fixable.

Strong committed management teams offer you a unique opportunity where not only is a drawdown in the investment likely not a sign of a broken investment; it is actually a productive learning experience that allows the manager to become better. Having said this, when managers flippantly address drawdowns by simply saying, “That’s to be expected,” or “We’re not concerned; that’s designed to happen very few years”, that’s not a good sign. You don't want managers to overreact to drawdowns, but being able to explain how and why something went wrong is a strong indication that not only may it be fixable, it also may not even be broken. We believe a good systematic trader takes every drawdown very personally.

D. An opportunity.

The markets have a strong tendency to make something look broken when in reality it is simply out of favor or out of the correct frequency with the market. When a drawdown occurs in this instance, you need to hold conviction and weather the loss and if you are not oversized in the position, invest more. This goes back to Letter C in our criteria for a good trading model. Every pullback is not necessarily an opportunity: Good managers will know when to make major/minor corrections and when to let the models work and capture the upside going forward.

A great systematic trading model is the sum of many parts; it is not as simple as a static set of robust rules that produce future signals that make money in the market.

-

You must start with a concept that in some way almost represents something similar to a law of physics where the trading opportunity is structural and can be explained by the behavior of market participants.

-

You must consistently have access to the same data continuously in the same time frequency with the same lags as you tested.

-

Your data conversions must remain consistent and be able to handle data outside what was experienced in the past.

-

You must have the ability to execute your signals consistently with how your model was tested and have a feedback loop to re-evaluate the model as it moves forward in time.

The primary key to a great systematic trading model is that it must perform as you would expect in future environments. Most importantly, you must remember that no model operates in a vacuum; a great trading model must be built to consistently produce results in the context of someone’s existing portfolio.

About RQSI

Ramsey Quantitative Systems, Inc. (RQSI) is a quantitative investment management firm headquartered in Louisville, Kentucky. Founded in 1986 by Neil Ramsey, RQSI has been a pioneer in systematic trading for over 35 years. RQSI’s investment strategies have earned numerous accolades including a 2019 win for Best Systematic Macro Fund at the HFM Global CTA Intelligence Awards.

Ramsey Quantitative Systems, Inc.

1515 Ormsby Station Ct.

Louisville, KY 40223

info@rqsi.com

502-245-6220