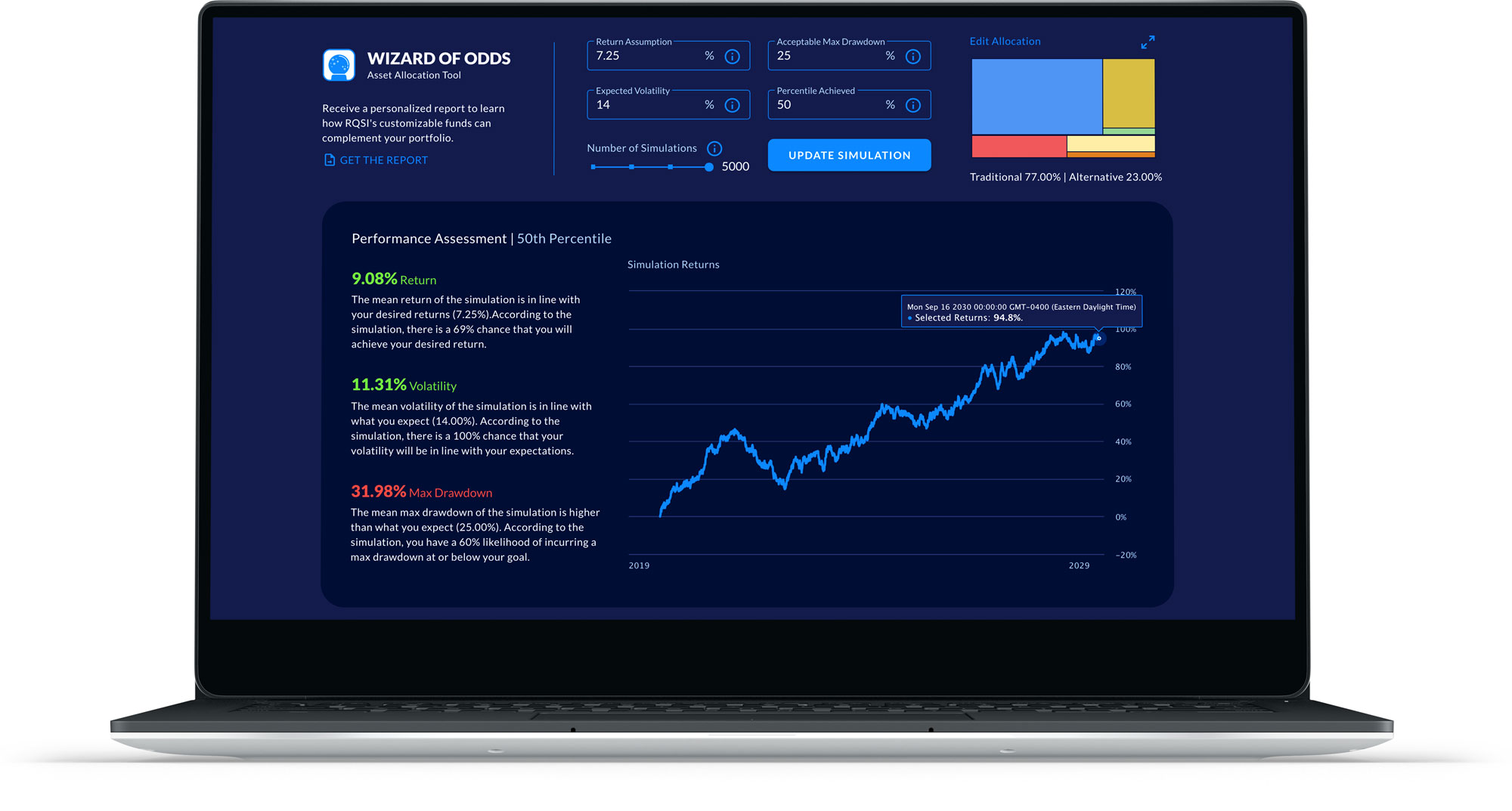

LOUISVILLE, Ky. - Ramsey Quantitative Systems, Inc. (RQSI) has launched the Wizard of Odds, a portfolio analysis and simulation tool that illuminates the implications of asset allocation strategies and provides insight into areas for improvement. After setting asset allocations as a percentage, investors can view historical performance as well as run the portfolio through a Monte Carlo simulation to assess the probability of the strategy meeting desired outcomes over time.

“We needed a way to accurately distill and analyze client portfolios to identify which of our products could make the greatest positive impact,” said Neil Ramsey, CEO of RQSI. “After reviewing dozens of institutional investment policy statements and developing a methodology to model portfolio variability, the underlying framework supporting the Wizard of Odds was born. It’s a helpful tool for diagnosing issues related to portfolio diversification.”

To begin the portfolio assessment, users input their asset allocations as a percentage to generate a close replica of the portfolio and view its historical performance from 2000 to date, displaying annualized returns, volatility, Sharpe ratio, drawdowns, and beta. Along with viewing portfolio performance from the last 20 years, users can drill down further to backtest how a given portfolio would have performed during specific stress events and periods such as the 2007-2008 financial crisis, the 2016 United States presidential election, and the coronavirus-induced market crash of 2020.

To simulate future performance and to identify shortcomings, investors can use the built-in Monte Carlo tool to generate up to 10,000 simulations for an approximate forecast of performance over the next ten years. For investors with specific goals or IPS requirements, users can input desired returns, volatility, and max drawdown to determine the likelihood of achieving them with their current asset mix.

“In the past, asset allocation studies would often take weeks to produce,” said Ramsey, who previously served on the board of the Kentucky Retirement Systems. “Our tool significantly condenses the time down to minutes, providing consultants and institutions a considerable head start on understanding the implications of their strategies.”

The Wizard of Odds is free to use and available immediately at www.rqsi.com/tools/asset-allocation-tool.

About RQSI

Ramsey Quantitative Systems, Inc. (RQSI) is a quantitative investment management firm headquartered in Louisville, Kentucky. Founded in 1986 by Neil Ramsey, RQSI has been a pioneer in systematic trading for over 34 years. RQSI’s quantitative funds have earned numerous accolades including a recent 2019 win for Best Systematic Macro Fund at the HFM Global CTA Intelligence Awards.